One thing that small business owners struggle with is managing their finances and record-keeping. It may seem to be quite a simple task, but after time it becomes clear that it’s more difficult than they initially imagined. Thankfully, there are software solutions that can greatly streamline these tasks and help you to stay organized. Two great solutions are Quickbooks and Xero.

What Quickbooks or Xero Can Do For You

Create Invoices: Get paid faster, receive updates when the invoice is opened and connect seamlessly with customers through online invoicing. Create professional recurring invoices and schedule bill payments to manage cash-flow. Payments, returns and credits are all tracked automatically.. Easily create custom invoices that represent your business, anytime and from anywhere with Quickbooks and Xero.

Make Payments Easier for your Customers: When customers receive a custom Quickbooks or Xero invoice from your company, they can pay instantly by using the “pay now” link, which allows them to make a credit card payment or check/bank payment directly from the invoice itself.

Photo-Capture Receipts: If saving a small paper receipt is a hassle, you can stop doing it with Quickbooks or Xero. There is a helpful feature that allows you to photograph receipts using your mobile device, and automatically attach them to your expenses.

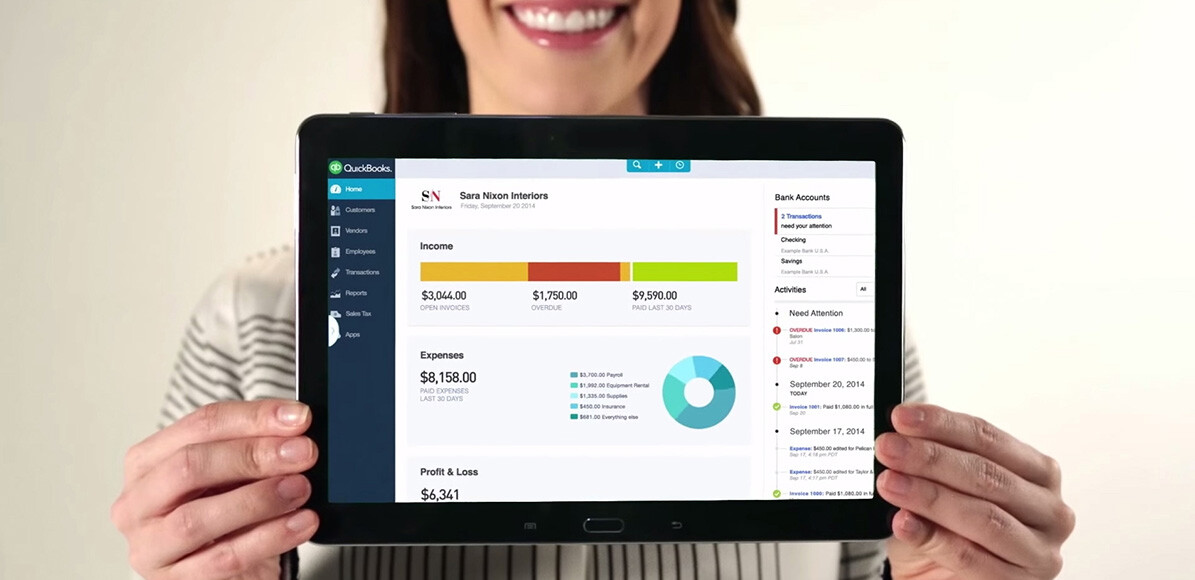

Auto Account Synchronizing: You can link Quickbooks or Xero to your bank accounts, credit card accounts, etc.—and allow it to automatically synchronize with these accounts. You won’t have to worry about data entry errors, and Quickbooks can use the synchronized information to create reports based on your transactions.

Payroll Simplification: Quickbooks and Xero can even help you to handle your business’s needs. It performs the necessary tax calculations for you, and even creates pre-completed tax forms based on your . It’s as simple as clicking. Both software allow integration with other software.

Reporting: All of this data, naturally, make preparing reports a breeze, and Quickbooks or Xero handle them for you. These reports include one-click option like balance sheets and profit and loss reports, which can then be sent to accountants or business partners to streamline transactions or tax preparation.

Easy Communication: By letting your bookkeeper or your accountant have access to your Quickbooks or Xero account, you can save an enormous amount of time. They’ll have direct access to nearly every piece of information they’ll need to handle your company’s financial business, so you won’t have to engage in lengthy correspondence with them.

Other Features

Some of the best features that Quickbooks, Xero software and other similar programs offer include constant availability through online access. You can access your account online, no matter where you are—and any time. Quickbooks, Xero also offers automatic data backup, so you don’t have to worry about losing important information. There’s really no reason to not use these excellent software solutions. It’s suitable for small to midsize businesses. In fact, even if you are an independent contractor, Quickbooks can be a helpful tool in keeping your bookkeeping straight.