Unlocking Business Success: Understanding Key Financial Ratios

In the dynamic landscape of business, success hinges not only on visionary leadership and innovative strategies but also on a deep understanding of financial health. One of the most powerful tools for evaluating a company’s financial standing is the use of key financial ratios. These ratios provide invaluable insights into various aspects of a company’s […]

Best Practices for Managing Accounts Payable and Receivable to Maintain Healthy Cash Flow

Managing accounts payable (AP) and accounts receivable (AR) is essential for maintaining a healthy cash flow in your business. Efficient management of AP ensures that you pay your vendors on time, while effective AR management helps you collect payments from your customers promptly. In this blog, we’ll share some best practices for managing AP and […]

Separating Business and Personal Expenses: Mastering Financial Hygiene

Navigating the world of entrepreneurship can be tricky, but managing your finances is key to keeping your business afloat and growing. One important rule is to keep business and personal expenses separate. In this blog post, we’ll explore why this is so important and share some easy tips to help you do it right. The […]

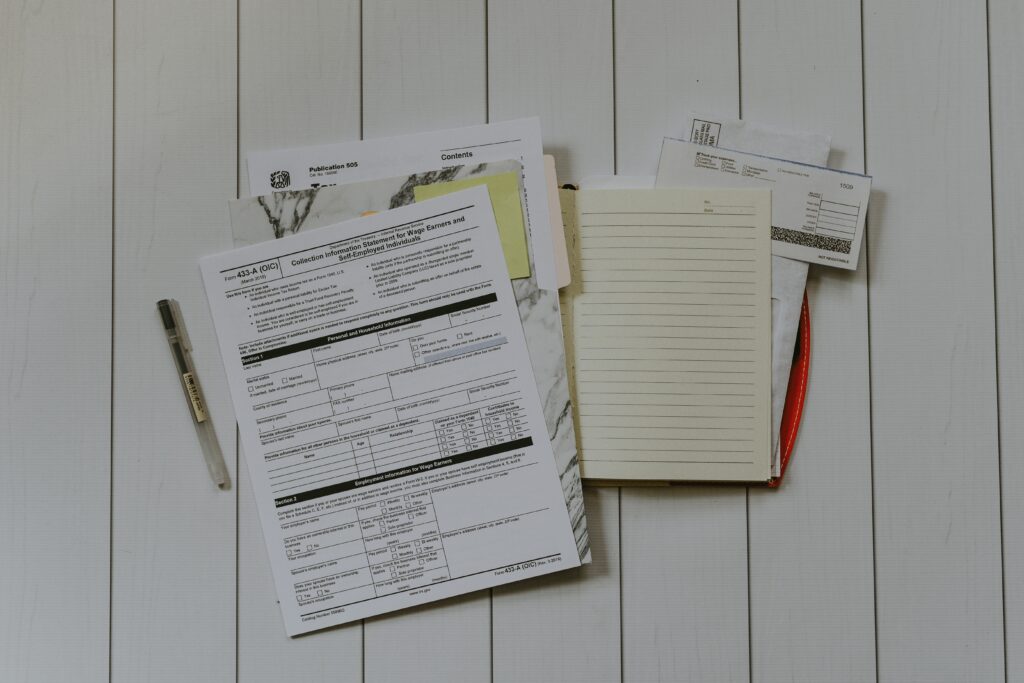

The Basics of Business Taxes

Navigating the complexities of business taxes is a crucial aspect of running a successful business. As a business owner, understanding your tax obligations and responsibilities can help you avoid costly mistakes and ensure compliance with tax laws. Keep reading to learn more about what business owners should know about business taxes. Understanding the Types of […]

How to Effectively Analyze Your Financial Statements

Financial statements are a crucial tool for understanding the financial health of a business. They provide a snapshot of a company’s performance and help stakeholders make informed decisions. Analyzing these statements can seem daunting, but with the right approach, anyone can gain valuable insights into a company’s operations. Let’s explore the key components of financial […]

How do HR and Accounting work together?

Human Resources (HR) and Accounting are two important departments within any organization, each with its own set of responsibilities and functions. While HR focuses on managing and developing the organization’s workforce, Accounting is responsible for managing financial transactions and reporting. Despite their distinct roles, HR and Accounting often work closely together to ensure the overall […]

The Difference Between Bookkeeping & Accounting: Unraveling Two Essential Components of Financial Management

When it comes to managing finances for any business, two crucial aspects often get intertwined, causing confusion among entrepreneurs and small business owners: bookkeeping and accounting. While both functions are essential for maintaining accurate financial records, they serve distinct purposes and require different skill sets. In this blog post, we will delve into the key […]

How Much Does a Bookkeeper Cost for a Small Business? (2023)

How much does small business bookkeeping cost? As a small business owner, keeping track of your financial records is essential for the success of your business. But how do you know if you should handle bookkeeping yourself or hire a professional? And if you decide to hire a bookkeeper, how much can you expect to […]

How Bookkeepers Support Tax Accountants During the Busy Tax Filing Season (2023)

If you’re a business owner who hasn’t yet hired a bookkeeper, now is the time to do so. For tax accountants, working with a bookkeeper can help them focus on their core responsibilities of preparing and filing tax returns.

3 Tips for Freshening Up Your Business’s Approach

Revising your business plan helps your company adapt to changing times. Here are some tips on how to help your business plan for the future.

It’s Time to Start Working on Your 2017 Budget

Many of your potential clients will be drawing up their own budgets for 2017. Use cloud based accounting software to get ahead of your competition.

Updated Accounting Solutions for Small Businesses

The best financial partnerships come with financial technology that makes sense for your size business. That means cloud-based accounting solutions.